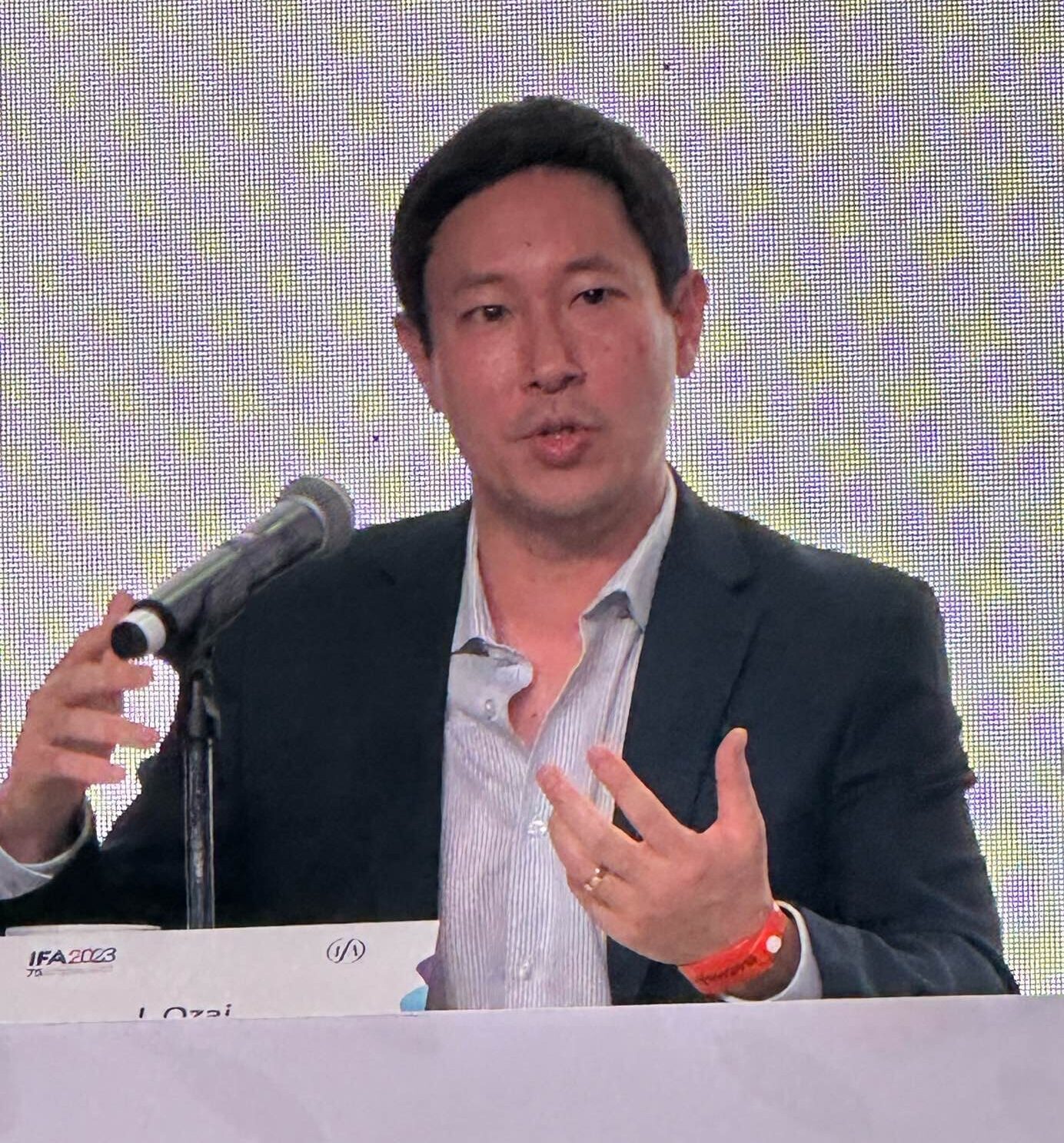

Ivan Ozai is a full-time professor at Osgoode Hall Law School, York University, in Toronto, Canada, where he researches and teaches national and international tax law and policy.

Before entering academia, Professor Ozai practised tax law in São Paulo for over a decade. He has also held senior government positions, including as a tax court judge and the Director of the Advance Tax Rulings Office of the State of São Paulo

Global Justice in the Reshaping of International Tax, 27:4 Journal of International Economic Law (2024), pp. 639-45.

Designing an Equitable Border Carbon Adjustment Mechanism, 70:1 Canadian Tax Journal/Revue fiscale canadienne (2022), pp. 1-33.

Inter-nation Equity Revisited, 12:1 Columbia Journal of Tax Law (2021), pp. 58-88.

Two Accounts of International Tax Justice, 33:2 Canadian Journal of Law and Jurisprudence (2020), pp. 317-339.

Institutional and Structural Legitimacy Deficits in the International Tax Regime, 12:1 World Tax Journal (2019), pp. 53-78.

Tax Competition and the Ethics of Burden Sharing, 42:1 Fordham International Law Journal (2018).

Benefícios fiscais do ICMS (book) [Tax Expenditures in the Value-Added Tax] (in Portuguese) (Rio de Janeiro: Lumen Juris, 2019).

JD Program

• Income Taxation, Fall 2024

• Consumption Taxation, Fall 2024

• Tax Policy, Winter 2025

• International Taxation, Winter 2025

LLM Program

• Canadian Law of Taxation, Summer 2024

• Comparative Tax Law, Fall 2024